Be Sure to Log Your Charitable Donations This Tax Season

Blessing Health • February 1, 2021

Be Sure To Log Your Monetary Donation This Tax Season

There are a lot of ways you can lend support to charities in need. For example, you can plan a fundraiser or you can volunteer. One even easier way to show your support is to make a donation to a nonprofit.

Even in the difficult economic climate brought about by the ongoing pandemic, Gallup reports

that 73% of adults living in the United States have donated cash to a charity in the past year. Whether you donated cash or something else, your generosity may reward you when you prepare your federal taxes.

Tax-Deductible Donations

In order for your charitable donations to help you out on your federal taxes, you must have donated to a qualifying charity. Luckily, the Internal Revenue Service makes finding qualifying nonprofits a breeze by maintaining a Tax Exempt Organization Search tool

on its website. If you donate to one or more of the eligible charities included in the IRS’s database, you’ll be able to deduct at least a portion of your monetary donation on your federal taxes.

Opportunities to Take Deductions

The IRS gives charitably oriented taxpayers several ways to lower their adjusted gross income and/or their taxable income on their federal returns. The key to taking advantage of any or all of these opportunities is to hold onto proof of your donations. If you donated money, keep a bank statement, canceled check, or credit or debit card receipt. People who donated property worth more than $250 should keep the receiving charity’s written acknowledgment of their gift.

The Coronavirus Aid, Relief, and Economic Security Act

The CARES Act passed in 2020 included some temporary tax changes at the federal level, including a special provision that allows people who donated cash to a qualifying charity and don’t itemize their deductions to take a $300 deduction from their AGI on their 2020 federal returns. If you’re eligible for this deduction, it will lower both your AGI and your taxable income.

Deduction for Financial Assets Held One Year or Less

If you have donated stock or another financial asset you held for one year or less to a charity like our Quincy, Ill. foundation, you can deduct the amount you paid for the asset on your federal return. If the asset appreciates while you owned it, you have to report the gain on your taxes.

Donations That Account for a Significant Amount of Your Income

Depending on your situation, you may find that your charitable donations account for a large amount of your income for 2020. Here is the breakdown of what you can deduct based on the type of donations you made to qualifying nonprofits:

- Cash: Up to 100% of your Adjusted Gross Income (AGI)

- Property: Up to 30% of your AGI

- Long-term securities: Up to 20% of your AGI

- Vehicles: Up to the amount the charity sells the vehicle for. If a qualifying charity decides to use a vehicle you donated instead of selling it, you may deduct the vehicle’s fair market value on your federal return.

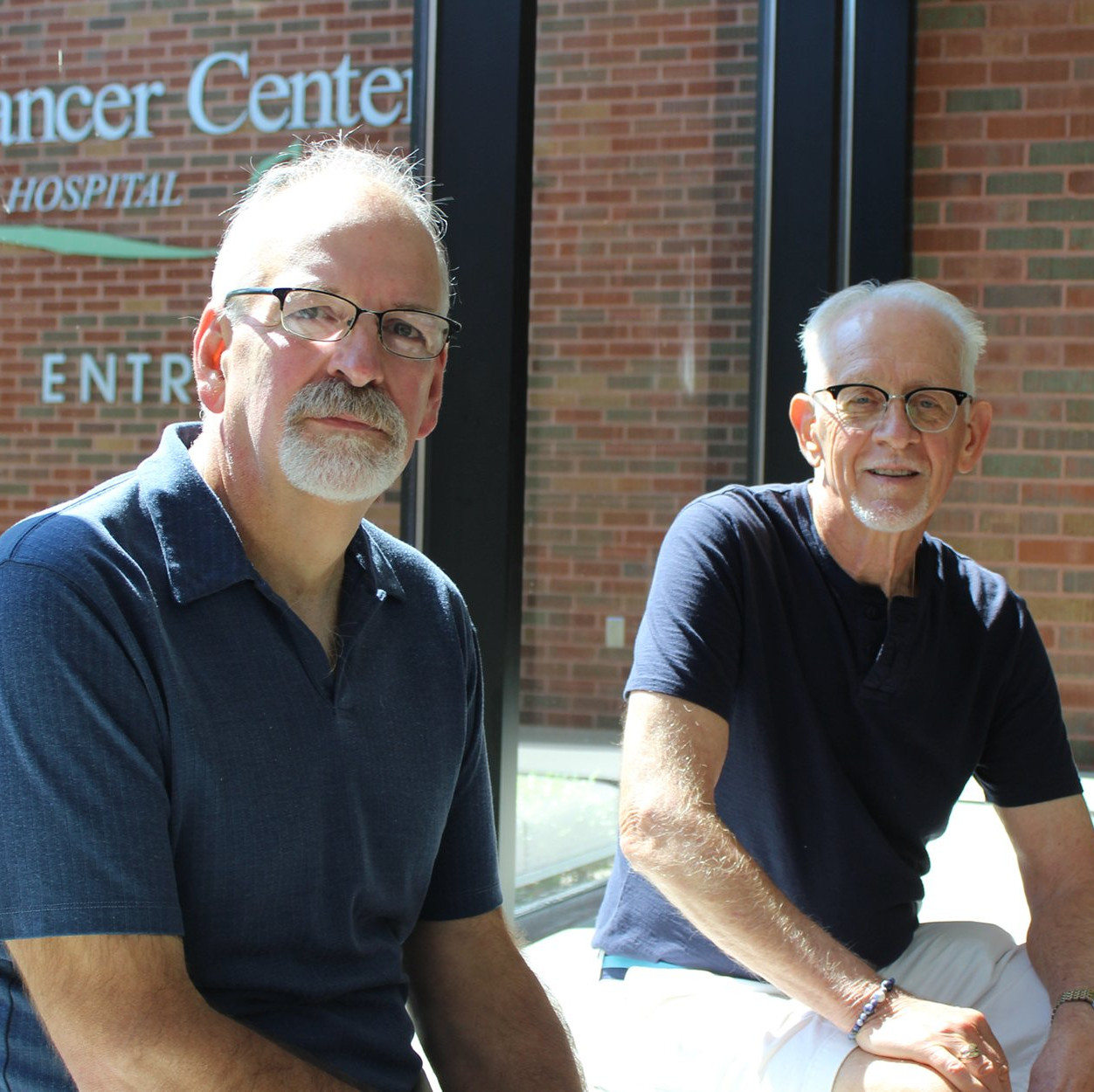

While it’s too late to make a tax-deductible monetary donation in Quincy, IL to a qualifying charitable foundation for 2020, it’s the perfect time to consider making nonprofit donations that can benefit you when you file your 2021 tax return. See what your gift can do when you donate to the Blessing Foundation

now!