Charitable Contribution Deduction: What You Need To Know

One way of helping a cause you believe in is through charitable giving. This act of altruism can benefit people in need, but it can also be favorable for you because you can claim a charitable contribution deduction. This allows you to deduct charitable donations from your taxable income. Here are essential details you need to know to claim deductions for your contributions:

Give Cash or Noncash Contributions

Consider donating cash contributions or properties, which are both tax deductibles. For monetary gifts, you can give cash, check, and credit. For noncash contributions like vehicles, jewelry, and artworks, their prices must be determined at a fair market value. The Internal Revenue Service (IRS) can allow deductions for these donated goods or properties if they are in good or better conditions when appraised.

However, you need to fill out Form 8283, a tax document for reporting certain noncash charitable contributions to the IRS, if they have a value exceeding $500. This paperwork must be filed along with your tax return.

Donate to a Qualified Charity

You can only deduct your donations if you give them to qualified charities. These include churches and other religious organizations, philanthropic groups, nonprofit veterans’ organizations, nonprofit cemeteries, child or animal abuse prevention organizations, and fraternal lodge groups.

These charities must meet the 501(c)(3) requirements of the IRS code. Check if the organization has a tax-exempt status on the IRS website. You can also ensure that the charity is nonprofit by consulting with a tax professional.

Record Your Charitable Giving

Always keep written records of your contributions. For every charitable giving, you need to include details like the amount, donation date, and the name of the organization that received the gift. Bank and credit card statements, as well as canceled checks, are great examples of records you can present to the IRS when you claim your deductions. Moreover, keep any written letters of acknowledgment from charities for donations worth $250 or more.

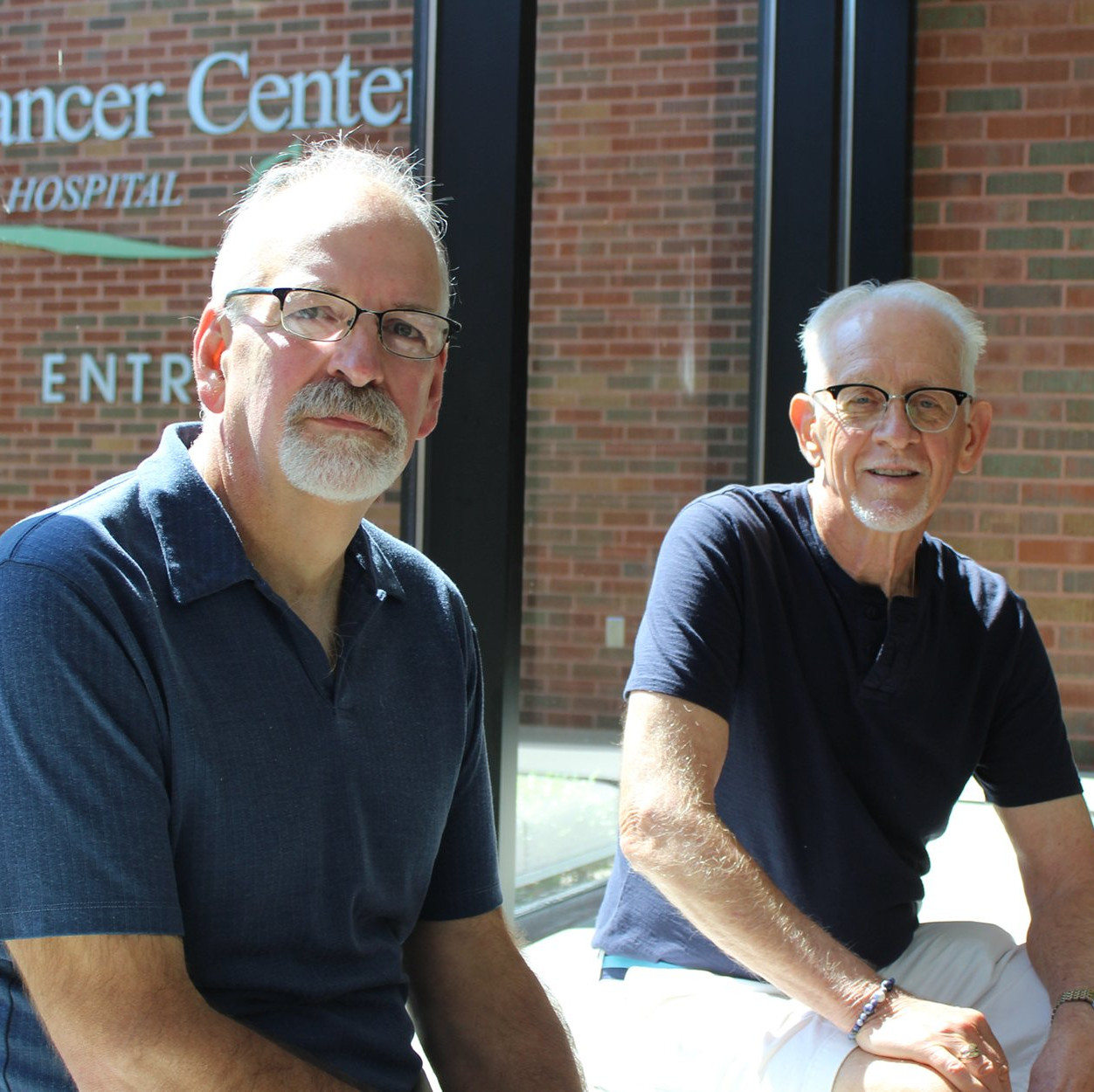

Contribute to a Charitable Foundation Today!

Now that you know what you can do to deduct your contributions, consider donating to a charitable foundation. Claim your deduction when you give to Blessing Foundation. Learn how your donations can help patients in Quincy, IL, and nearby communities. Contact us today!