How Contributing to Charity Affects Your Tax Return

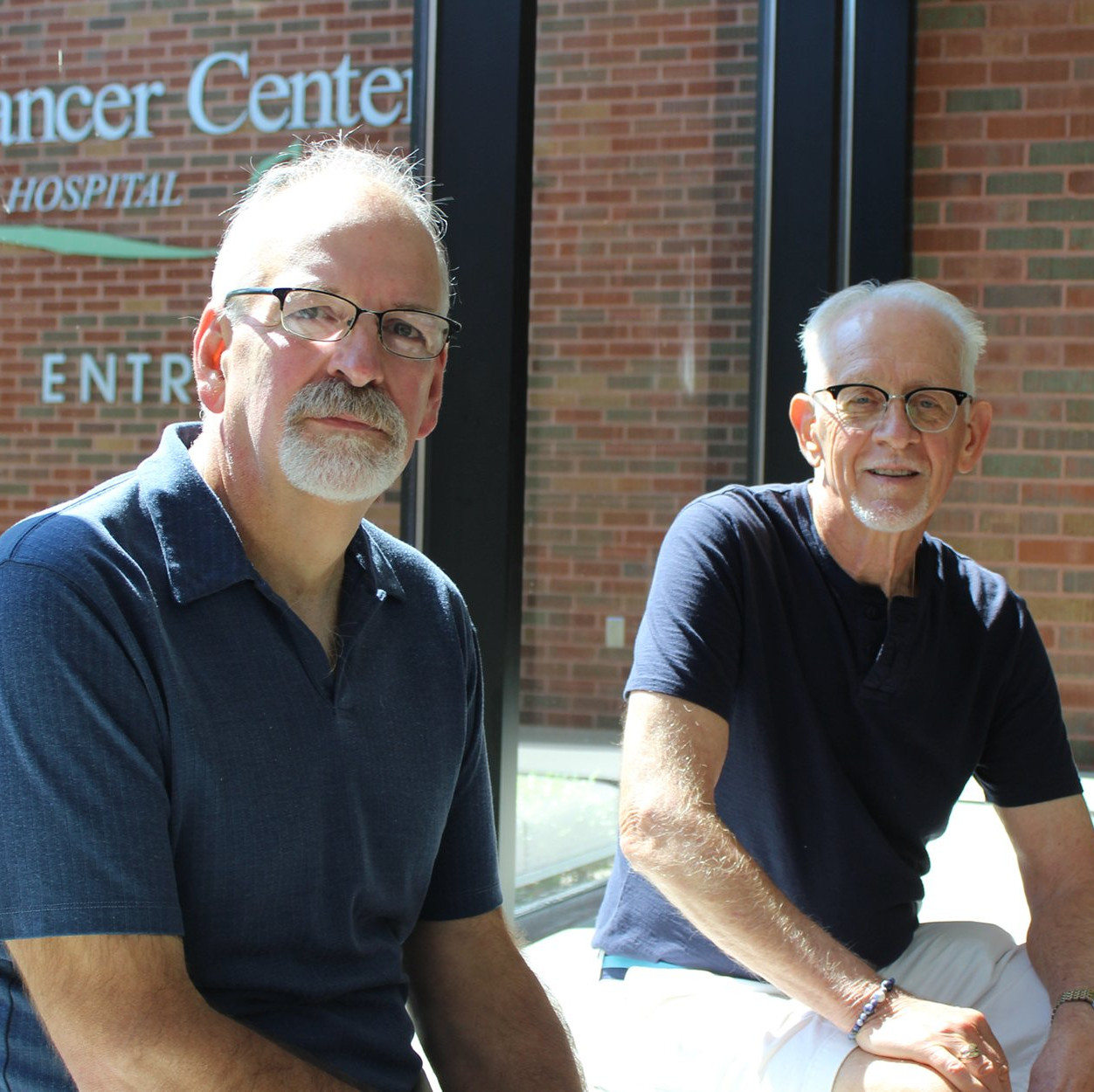

What Qualified Charities You Donate To

The recipient of your contribution affects your potential tax benefits. Ensure that your chosen nonprofit organization is tax-exempt. You can only give tax-deductible donations to qualified charities with 501(c)(3) status. Verify their legitimacy and tax-exempt status by checking their data with the Internal Revenue Service (IRS).

Keep in mind that you need receipts for your charitable giving in order to claim tax breaks with the IRS. Some charities require a minimum donation before you can request a bank statement or receipt from them. Check with the recipient to learn how much you can give to receive proof of your charitable giving.

Which Method Can Give You Greater Tax Benefits

You can donate how much you want, but remember that charitable donations can generally have a deduction of up to 60% of your adjusted gross income (AGI). However, depending on the kind of donation, some cases have lower thresholds like 50%, 30%, or 20%.

You must itemize if you want to claim charity tax deductions between 20% and 60% of your AGI. For this approach, you must record all your charitable donations on your tax returns to prepare for IRS audits. However, you can also use standard deduction if you pay a smaller tax bill than when you itemize.

What Type of Donation You Give

Your potential tax benefits can also vary based on the form of your charitable contributions. Monetary donations like cash, credit, and checks aren’t your only charitable giving options. You can also give appreciated securities like bonds, stocks, or mutual funds directly to the charity of your choice and still receive tax breaks.

Other noncash donations that are also tax-deductible include jewelry, patents, real estate, vehicles, and artworks, among others. To get the appropriate tax deductions for these nonmonetary contributions, make sure they are properly appraised with their fair market value.

Consider these things whenever you give to a charitable foundation so you can reduce your taxes. Though getting tax deductions is a great incentive for charitable giving, the main motivation should be bringing positive changes to the community. You can make a difference by donating to the Blessing Foundation today. Contact us to learn how your contributions can help patients in Quincy, IL, and the surrounding region.