How To Maximize Your Charitable Giving

Gray Digital • April 15, 2022

The most common form of philanthropy is giving donations through a charity that supports your cause. Though this is the standard method, many people don’t know how to maximize their tax deductions when they donate. If you’re charitably minded and want to make a bigger impact through your donations, here are ways you can make the most of your charitable giving.

1. Bunch Your Charitable Donations

Instead of donating small amounts every year, you can choose to give a larger chunk to a charity every few years to minimize your tax hit. This is ideal and advantageous for people with enough funds to give several years’ worth of donations in one year.

2. Give Appreciated Securities

People commonly give cash or checks to charitable organizations. However, consider donating appreciated securities like stocks, bonds, or mutual funds to get the most out of your contribution. This form of charitable giving lowers your taxes by keeping the amount donated out of your taxable income in the first place.

When non-cash assets are sold, you also owe capital gains tax. Instead of selling assets and then donating the proceeds, you can avoid paying for capital gains by directly giving those highly appreciated securities to the organization.

3. Set Up a Donation Advised Fund (DAF)

If you want to invest your charitable donations, consider establishing your own DAF. When you fund it with cash or highly appreciated assets, your contribution in that year immediately receives a tax deduction.

You decide when and how much you want to distribute to qualified charities. Your donations can go to one or multiple charities over time. Because DAF is loosely similar to traditional investment accounts, the donations you put in the fund have the potential to grow tax-free. You can let the assets sit in the fund as long as you want, and the longer those contributions stay there, the more they increase in value.

4. Consider Qualified Charitable Distribution (QCD)

To be eligible for QCD, you have to be at least 70 ½ in age, and you need to have an Individual Retirement Account (IRA). A QCD allows you to annually donate up to $100,000 from your account directly to a charitable organization approved by Internal Revenue Services (IRS) without getting any tax hit. QCDs can also take the place of your required minimum distribution (RMD) of the year if it has not already been met.

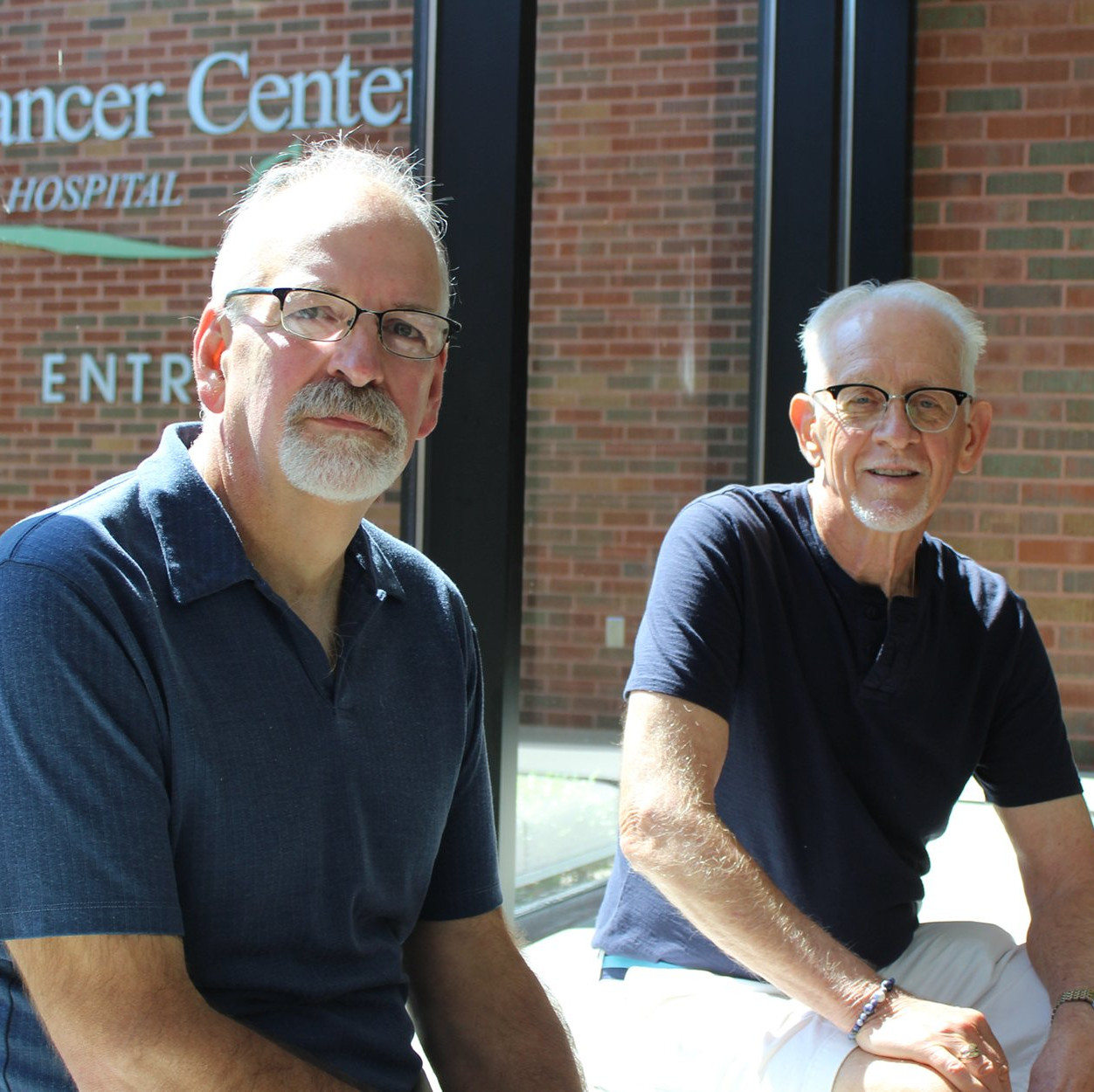

Maximize your charitable contributions by considering these strategies. You can also make the most out of your charitable giving by donating to the Blessing Foundation. With your help, our charitable foundation

can provide financial assistance to patients in Quincy, IL, and the surrounding region. Contact us today!