Setting Up a Charitable Foundation

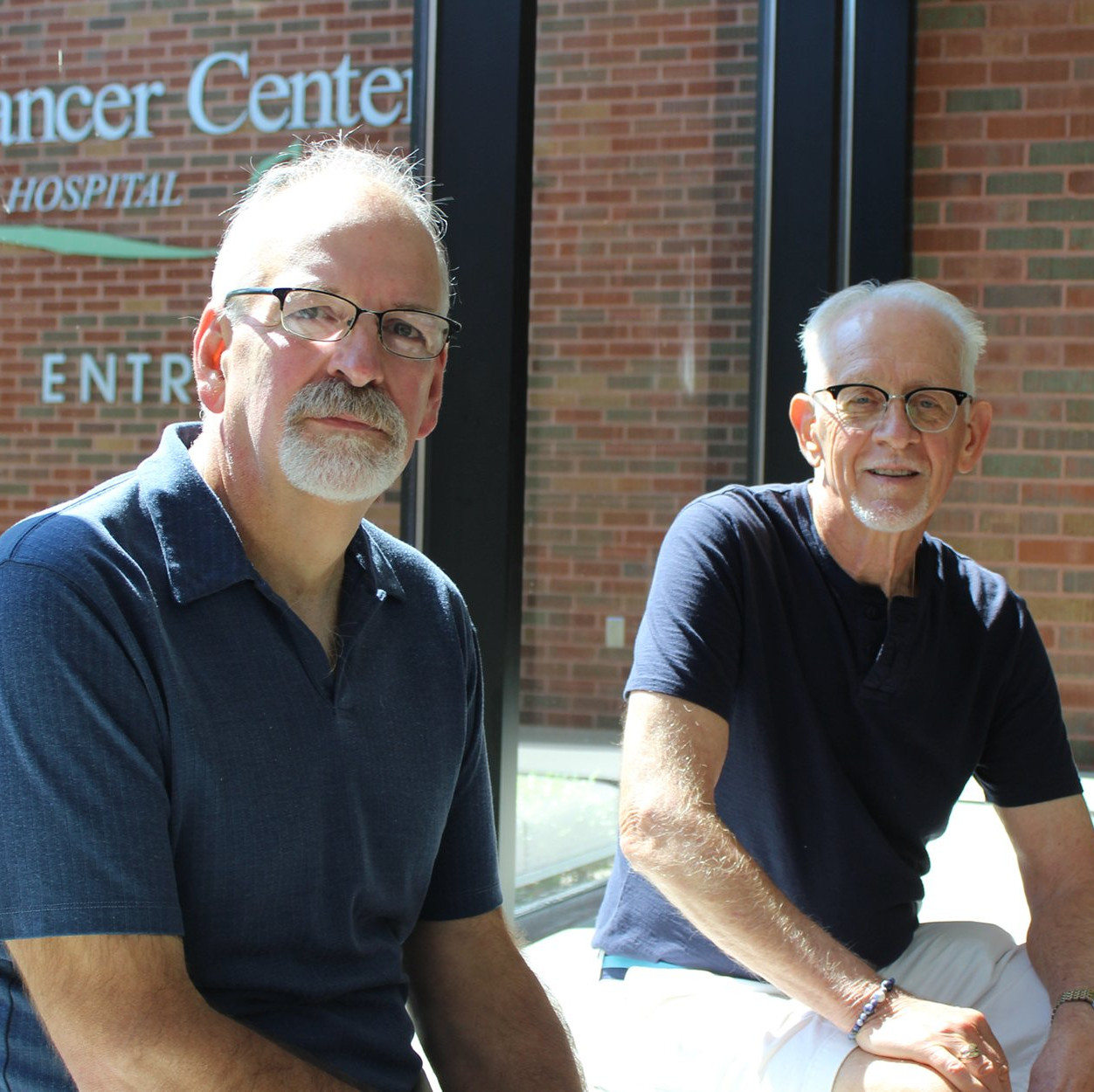

Setting up charitable organizations for a specific cause is a great and effective way to conduct philanthropy. Whether it’s from a business or yourself, foundations offer many advantages and open up a lot of opportunities for you to be able to give back to the community. You may consider creating your own

charitable foundation in Quincy, IL. Here is some information you should know.

Key Things To Know When Starting a Foundation

The opportunity to have a lasting positive change doesn’t come to people often. Here are some key pointers to be mindful of:

- Know the Different Types of Charities – Charities can have various purposes, from animal welfare to education and environmental awareness. Choose a cause that you wholeheartedly support and start from there.

There are primarily two main types of charities: private foundations and public charities. Private foundations are mostly operated by a select few individuals, and they are usually funded by a large initial investment. Public charities, on the other hand, are more hands-on when it comes to their finances. They rely mostly on soliciting donor funds to conduct their projects.

- Establish Your Organization’s Mission – To keep track of your goals, you must establish a mission statement. It should contain your organization's core values and purpose to be transparent with what you would like to achieve as a charity.

- Follow State and Local Requirements – Before you can operate as a charity, you have to meet the requirements for setting up a charity. Make sure that your organization is registered. Be sure to have your foundation compliant with IRS requirements so that you can get your tax-exempts.

- Determine Your Charity’s Strategy – Once you have been approved to operate, determine your next move. You can go for a long-term legacy or make a short-term impact first to get more support down the line.

When To Start a Charity?

Often enough, when you’re selling off a business, you can start up your very own private foundation. By selling the company shares you own, you can lessen your tax liabilities and use the funds for more charitable means. The foundation can be funded by private or publicly traded stock.

Assets contributed to private foundations are not subject to taxes. Because of this, many high-net-worth individuals like multimillionaires set up their own charities on their retirement. By giving back to the community, they’ll pay fewer taxes and contribute a lasting legacy as a philanthropist at the same time.

For public organizations, the best time to start off a charity is now. If you have a passion for helping out in your community and the means to organize, then starting up your own foundation should be one of your top priorities.